Turn to us for R&D tax credit guidance

Reduce Your Company's Tax Bill

If you're looking to decrease your company's tax liability, reach out to Fidus Associates. We provide R&D tax credit guidance and information for businesses nationwide. R&D tax credits result in an immediate benefit to a company by reducing current and future federal tax liability, creating a ready source of cash.

Check out some of the benefits of R&D tax credits

These tax credits are given to companies for performing activities related to the development, design or improvement of products, processes, formulas or software. Receiving one will potentially help you by:

- Providing a dollar-for-dollar offset against taxes owed or paid

- Reducing your company's effective tax rate

- Increasing your earnings-per-share

- Assist in obtaining immediate sources of cash for many small and mid-size companies

- Create a significant reduction to current and future years federal and state tax liabilities

Call us today at 678-439-0877 to get R&D tax credit guidance and information.

A diverse range of industries taking advantage of R&D Tax credits

“R&D” Purposes Defined

Permitted Purpose

- New or improved business component (PPFIST) created for a permitted purpose Functionality, Performance, Reliability, or Quality

Elimination of Uncertainty

- Unknown method to develop or improve, unknown capability to develop or improve, unknown appropriateness of final design

Process of Experimentation

- Systematic process designed to evaluate one or more alternatives

Technological in Nature

- Fundamental reliance on the principles of physical sciences, biological sciences, engineering, or computer science

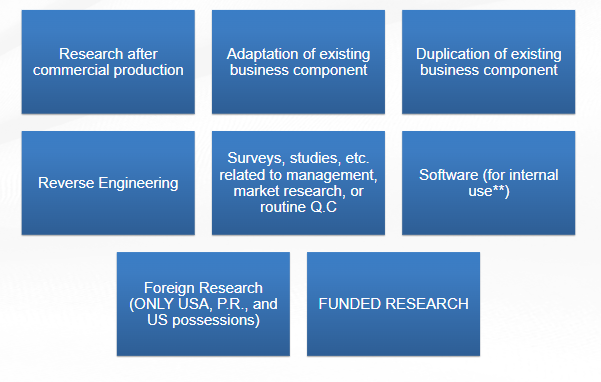

R&D Tax Credit Statutory Exclusions

COMMON OBJECTIONS

Why doesn't my accountant do this?

- most CPA’s don’t have the resources or expertise needed to locate and capture the full value of your refunds, which is why so many partners with specialists like is to handle that part of your return

I don’t think I qualify for this

- If there is creation and process involve, uncertainty on whether it will be a success or failure, be technical in nature and have a process of experimentation, then you will highly qualify.

Does this increase my chance of audit?

- The chance of audit is extremely low, but also covered in our service and we have 98% sustention rate.

Will the process take a long time?

- The reason we’ve won several multibillion dollar companies. We are masters of expedite process because we truly give value by performing multiple backend work.

Contact us now to arrange for R&D tax credit guidance services. We'll be happy to give you a free consultation.

Copyright © Fidus Associates | All Rights Reserved

300 Colonial Center Parkway Suite #100

Roswell, GA

30076

Nothing on this website is intended to advise anyone regarding legal remedies for a particular circumstance. Many matters of law are quite complex and may require special knowledge of legal principles and procedures. Integrated Trust Systems attorneys will provide legal advice and counsel to eStatePlan™ clients.